This post is a record of the questions and answers I’ve encountered while researching this topic. This is a work in progress.

What is the split between existing housing stock and new construction in the Netherlands?

At the start of 2023, there were 8.125.229 dwellings in the Netherlands, with an expected net addition of ±79.000 dwelllings over the course of 2023. This represents ±1% of the existing stock.

This net addition breaks down to: (estimated figures for 2023):

- +74.000 dwellings. New construction

- +24.500 dwellings. Alternative forms of addition (transformation, etc)

- -19.500 dwellings. Demolition and other forms of removal

Sources: CBS Statline, Bouwproducten blog, ING Building & Construction outlook

To what degree is the housing stock futureproof?

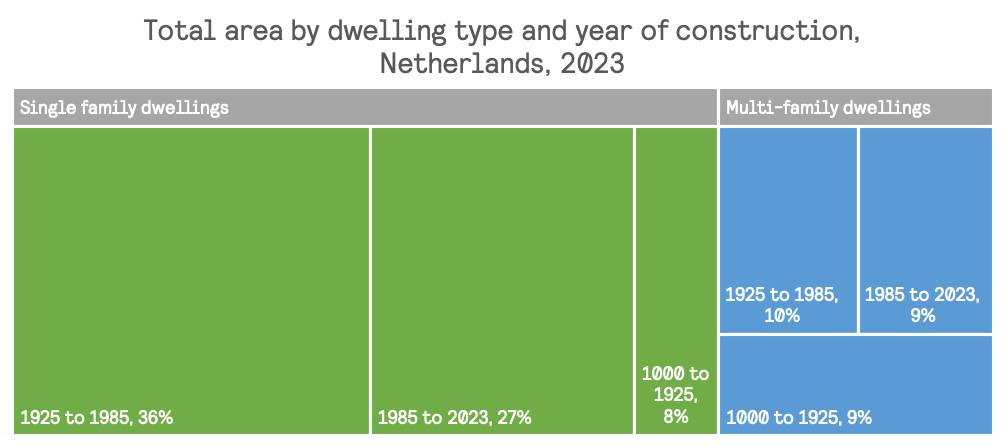

To get a grip on these figures, I group dwellings into buckets according to their year of construction. There are two clear demarcation points between these buckets: the first one around 1920-1925, when single layers of bricks started getting replaced by two layers with a layer of air inbetween. The second demarcation point is around 1975-1985, when the layer of air inbetween the bricks is usually filled with isolation material, and double-layered glass is used more and more.

- pre-1925s: single-layer brick walls, single-layer glass panes.

- 1925-1985: double brick walls with empty (air-filled) cavities

- 1985+: double brick wallls with cavities filled with isolation materials, double-layered glass.

Source: CBS Statline, Woonbewust

Looking at the figures we can see:

- Energetically speaking poorly constructed dwellings (pre 1985) make up 64% of the total housing stock by surface area, representing 665 square km of housing surface.

- The single largest category are single family dwellings (freestanding or semi-detached) built between 1925-1985, which make up 36% / 380 square km of the total housing stock surface.

What activities relate to the futureproofing of dwellings?

- Energy performance analysis: finding improvements, improvement plans

- Energy systems: solar system installation, heat pump installation, heating systems, energy storage facilitiy installation, short-term energy storage, long-term energy storage (hydrogen), gas to electricity conversion

- Isolation: cavity walls, crawl space, attic, basement, windows, green roofs

- Spatial: (prefab) building extensions, dormer window installations

- Internal comfort: airconditioning, underfloor heating

- Interior renovations

- Financial: subsidies advice, apply for subsidies, financing (buy now pay later)

- Behavior of occupants: consumption awareness, skills to improve consumption, wish to improve consumption

What types of companies are active in this domain? What niches do they represent?

- Insulation companies

- Glaziers

- Prefab extensions / prefab installers

- Heat pump installers

- Solar panel installers

- General contractors

- Sedum roof suppliers, sedum roof installers

- Home improvement advisors

- Financial advisors

What services do these companies provide?

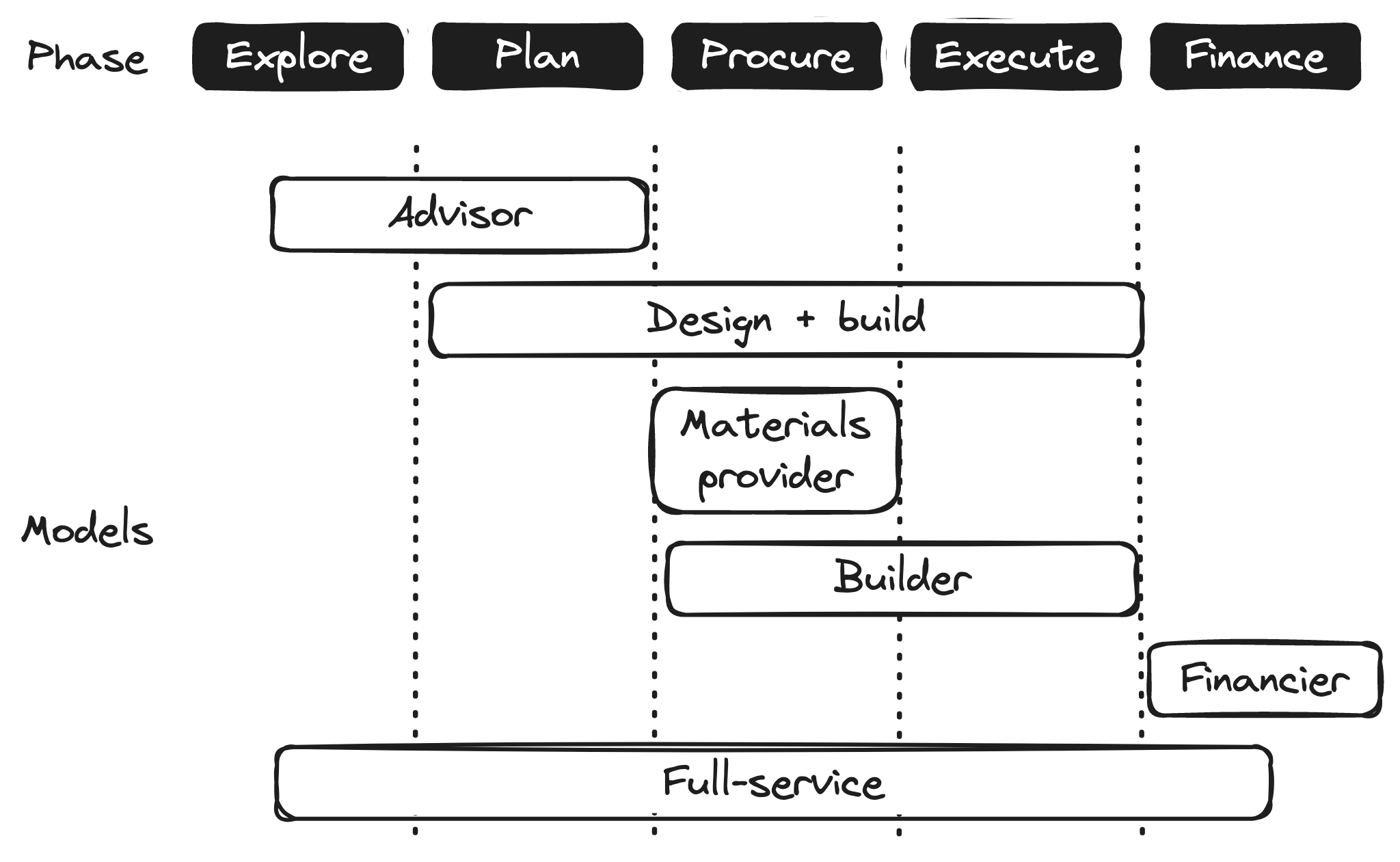

We can look at this through the lens of the phases that a project goes through. Not all companies cater to all phases, so we need to identify the phases to be able to relate the companies.

In the built environment, a typical business to consumer project has the following phases:

- Explore: explore opportunities, provide rough financial indication, feasibility study

- Plan: make plan of approach, design solution

- Procure: get the raw materials, do manufacturing to get the materials ready for installation

- Execute: installation of the materials

There is also an overarching financial aspect, effectively providing loans for the services, and/or allowing customers to split the payment into chunks.

Companies provide services in these domains through different models. Below a summary of how a couple of those models span across the different phases:

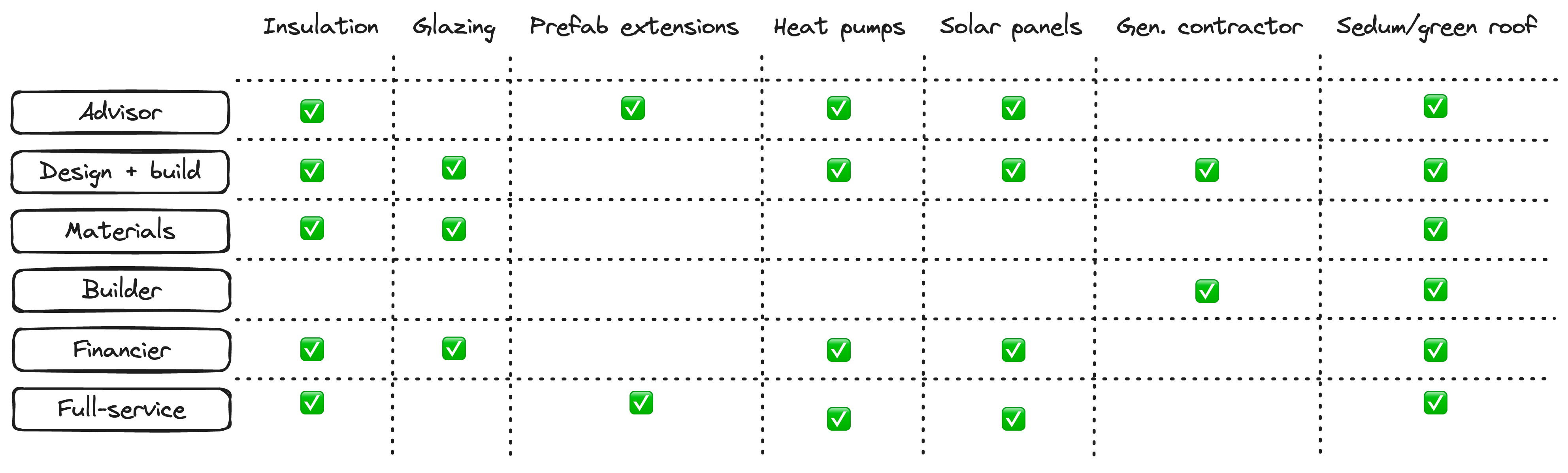

I’ve searched for companies offering services within all the above mentioned niches, and I’ve looked at the type of services they provide. The table is to be understood as: for each checked intersection, I was able to find at least one company offering this specific service, for this niche.

From this we can derive:

- Virtually all niches are served through the design+build model and the full service model.

- Virtually all niches have separate advisory services being offered, with the exception of glazing and general contracting.

- Most niches have separate financing methods, in this case, loans by a government-backed entity

- Material-only services seem to only exist for niches where the installation is low-tech

- “Just build it”, where the planning phase is left to the customer, occurs little